First Half of Higher Missoula Property Taxes Must be Paid Soon

Missoula, MT (KGVO-AM News) - According to Missoula County Clerk and Treasurer Tyler Gernant, many in Missoula County are reeling over the much higher property taxes due on their homes and property.

KGVO News spoke to Gernant on Monday, who said there are some programs available to those with low or limited incomes to help them deal with the taxes that still must be paid on time.

Many Missoula County Residents are seeking Help from the Department of Revenue

“Some people are going to qualify for property tax assistance in one form or another, and all of those programs are through the Department of Revenue,” began Gernant. “We direct them to the Department of Revenue. Some folks may have an error in the description of their property. So again, that has to be resolved with the Department of Revenue, but we can help them look to see if there is one, and then direct them over there to get help. And for most folks it just kind of ‘is what it is’ and there's not a whole lot we can do or help them.”

Gernant Those who Fail to Pay Property Taxes Could Lose Their Homes

Gernant mentioned some specific programs that may help property taxpayers deal with their much higher tax bills

“There are certainly people who have a low enough income that they qualify for property taxpayer assistance,” he said. “There's the elderly tax credit that also is something that some folks would qualify for. The specific qualifications for that are all handled again by the Department of Revenue. We have to direct folks over there, but I absolutely recommend that if you think you might be eligible for one of those programs, that you contact the Department of Revenue.”

Those with Questions Should Contact the Montana Department of Revenue

Gernant said it is true that those who cannot or simply refuse to pay their property taxes can lose their homes altogether.

“It takes at least three years, if you have a home to lose it to taxes, and the law has changed pretty substantially in that on the last, probably two or three legislative sessions,” he said. “It used to be that if you had an occupied home, after three years of having not paid your taxes, you would lose it to whoever paid the taxes, essentially. That process has changed now to where it has to go to an auction at the end of three years, and the starting price at the auction is half of the assessed value. So at the very least, you're going to be eligible to get some of that money back.”

Gernant provided the hard dates at which property taxes are due, and the penalties for not paying on time can add up quickly.

“As of this year, you have to pay each half, and the first half is due on December 8, because we were late getting the tax roll from the state,” he said. “Then the second half is due on May 31, 2024. If you're late paying them, there is a 2 percent penalty. So 2 percent of the amount that was due and owing on the due date will automatically be added as a penalty. In addition to that, there is a 10 percent interest added per day. That’s 10 percent annualized, obviously, but it accumulates each day.”

Get more information on help from the Montana Department of Revenue here.

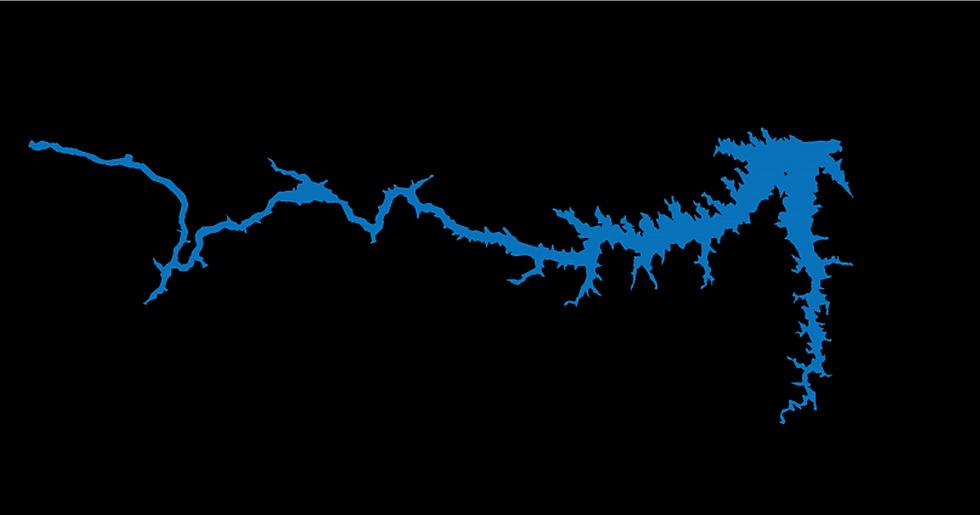

LOOK: Where people in Montana are moving to most

Gallery Credit: Stacker