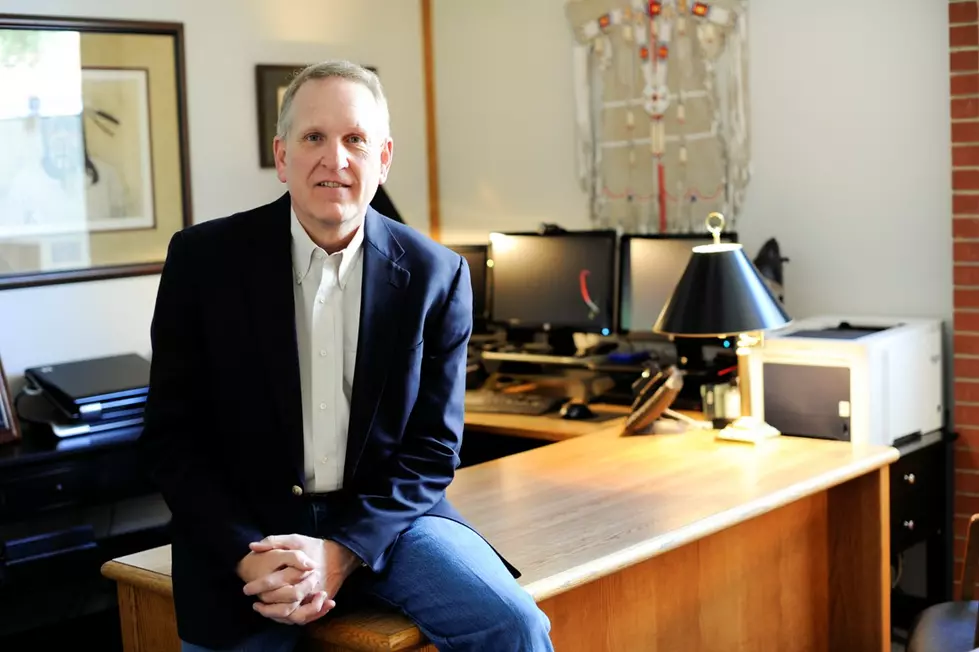

AG Tim Fox Advocates for Casinos to Receive Pandemic Relief

Montana Attorney General Tim Fox has written letters to the U.S. Small Business Administration to include casinos and other establishments that receive gambling revenue to be eligible for relief under the Paycheck Protection Program.

“Our office of the Montana Department of Justice and the Gambling Control Division regulated gambling,” said Fox. “We have over 1,300 businesses across the state that have gambling revenues and are licensed by our department. Sure enough, the rules for the Small Business Administration include a provision that makes any small business with revenues from gambling of a third or more is ineligible for disaster and emergency relief programs through the SBA.”

Fox said he took action immediately upon learning of that aspect of the SBA’s policy.

“I immediately called the White House and alerted them to that and they got me the names and phone numbers of the SBA in Washington, D.C. and they confirmed the existing rules, so I asked them to change it,” he said. “Unfortunately, I found out later that they had not changed the policy, so now I am officially lobbying the SBA to change the rules under their emergency rule-making provisions in which they could almost do it overnight.”

Fox said he had yet another avenue to pursue in his effort to include casinos in the Paycheck Protection Act.

“As the President of the National Association of Attorneys General, I’m drafting a letter for my 56 Attorney General colleagues to consider joining on behalf of their constituents and small businesses who are also ineligible for the relief and that will be circulated next week,” he said. “More than likely, that letter will be addressed to Vice President Pence who is leading the President’s efforts on COVID 19 response as well as copying the letter to the head of the SBA. Restaurants, bars, taverns, and casinos are the economic foundation of many communities in our state. They not only contribute substantially to our economy, but they also meaningfully contribute to their communities in additional ways.”

More From 94.9 KYSS FM